Climate change poses an existential threat to our planet, demanding urgent action from all sectors of society, including the financial industry. The global economy is intricately linked to the environment, and climate change could disrupt economic stability and growth.

Financial institutions are uniquely positioned to drive significant change in the battle against climate change. By redirecting capital towards sustainable investments and adopting greener practices, banks and other financial entities can play a pivotal role in steering the global economy towards a more sustainable future.

In this light, the United Nations Environment Programme Finance Initiative (UNEP FI) introduced the Net-Zero Banking Alliance (NZBA), laying a roadmap for banks worldwide to align their lending and investment portfolios with net-zero emissions by 2050. This initiative represents a critical step in mobilizing the financial sector’s resources and influence to combat climate change.

As we unpack the UN’s ambitious climate goals for financial institutions, we’ll explore how the NZBA Version 2 Guidelines aim to transform banking for a greener future, the key principles and targets these guidelines set forth, and the broader implications for the financial sector and beyond.

The UN’s Net-Zero Banking Alliance (NZBA) Version 2 Guidelines

The Net-Zero Banking Alliance (NZBA), a cornerstone initiative under the United Nations Environment Programme Finance Initiative (UNEP FI), embodies the commitment of the global banking sector to a sustainable future. Formed in April 2021, the alliance swiftly became a beacon for financial institutions worldwide, signaling a unified move towards aligning banking operations with the goals of the Paris Agreement — notably, achieving net-zero greenhouse gas (GHG) emissions by 2050.

Version 2 of the NZBA Guidelines, released in March 2024, marks a significant update, reflecting the evolving understanding of what it takes to transition the banking industry towards net-zero emissions.

The updated version of the guidelines will apply to all new targets and any new iterations of existing targets set by NZBA member banks after 22 April 2024.

Key updates in Version 2 include:

- Expanded Scope: For the first time, the guidelines explicitly include banks’ capital markets activities. This is a critical evolution, acknowledging that for many institutions, services related to the issuance of new debt and equity instruments represent a substantial portion of their carbon footprint.

- Enhanced Transparency and Reporting: Emphasizing the importance of clarity, the updated guidelines call for more detailed reporting on banks’ progress towards their net-zero targets, ensuring stakeholders have a clear view of the journey.

- Refined Targets: The introduction of more nuanced, science-based targets highlights the alliance’s commitment to the latest climate science, ensuring that the banking sector’s efforts are genuinely aligned with global climate goals.

The NZBA is not just about setting ambitious targets; it’s about providing a framework for action. It’s a call to arms for banks to rethink their operations, investment strategies, and client engagement practices. By signing onto the NZBA, banks commit to a rigorous, science-based approach to reducing their carbon footprint, extending beyond their direct operations to influence the broader economy.

Amid these global efforts to combat climate change, Latinia offers innovative real-time decision-making products that empower financial institutions to not only align with the NZBA guidelines but to redefine customer engagement through sustainability-focused actions.

Latinia’s Critical Events Gateway and NBA (Next Best Action) engines utilize the LIMSP architecture to deliver targeted, personalized, and timely communications, enabling banks to promote green financing options, sustainable investment opportunities, and eco-friendly practices among their customers.

By leveraging real-time data and AI-driven insights, Latinia helps banks to enhance their role in the fight against climate change, transforming every customer interaction into a moment of environmental advocacy and action. This approach not only aligns with the NZBA’s ambition for a net-zero future but also elevates the customer experience by embedding sustainability into the fabric of everyday banking.

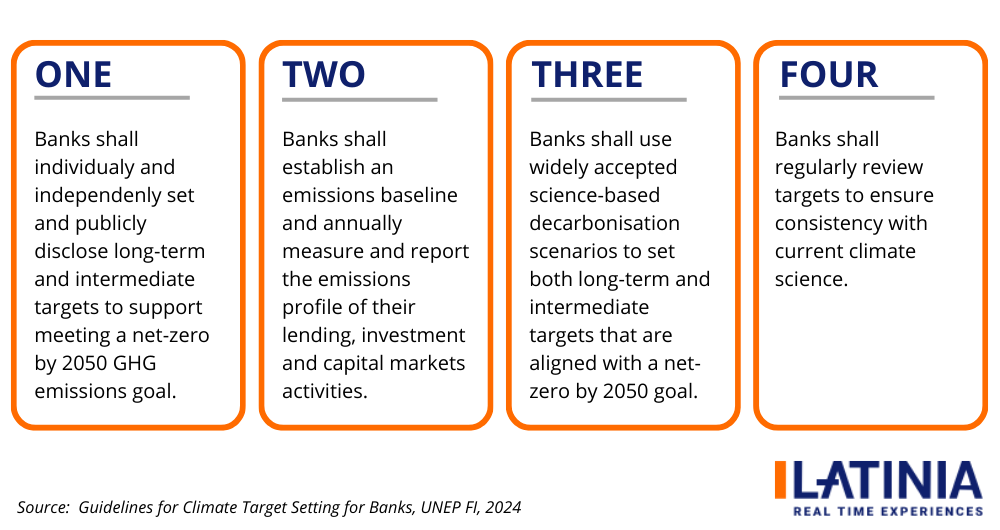

Enumeration of the NZBA Guidelines

In this section, we enumerate and briefly describe the four pivotal guidelines that underpin this ambitious initiative. By following these guidelines, banks commit to a transparent, accountable, and science-based approach to reducing their carbon footprint and supporting the global transition to a low-carbon economy.

1. Guideline One: Setting and Publicly Disclosing Targets

Objective: Banks must set, publicly disclose, and commit to long-term and intermediate targets to support the transition to net-zero GHG emissions by 2050.

Key Features: This includes setting targets for 2030 (or sooner) and 2050 that are aligned with a 1.5°C global warming limit, covering a significant majority of a bank’s financed emissions across all or a substantial majority of specified carbon-intensive sectors.

2. Guideline Two: Establishing Emissions Baselines and Reporting

Objective: Banks are required to establish a baseline for their emissions and annually report on their emissions profile, covering both absolute emissions and emissions intensity.

Key Features: This involves disclosing the scope and boundary of included asset classes and sectors, the coverage of emissions, and the methodologies and metrics used at portfolio, asset class, or sector level.

3. Guideline Three: Using Science-Based Decarbonization Scenarios

Objective: Banks must use widely accepted, science-based decarbonization scenarios to set both their long-term and intermediate targets, ensuring alignment with a net-zero by 2050 goal.

Key Features: This includes relying on scenarios aligned with a 1.5°C outcome from credible sources, such as IPCC scenarios, and disclosing the chosen scenarios, assumptions, and rationales behind their target-setting processes.

4. Guideline Four: Regular Review and Update of Targets

Objective: To ensure that targets remain relevant and ambitious, banks are obligated to regularly review and, if necessary, revise their targets to stay consistent with the latest climate science.

Key Features: This requires a formal review of targets at least every five years, recalibrating targets based on significant portfolio changes, methodological developments, or advancements in climate science.

Key Principles and Targets of the NZBA Guidelines

The guidelines we’ve enumerated introduce comprehensive principles and targets designed to steer the banking sector towards a sustainable future. Let’s break down the core components:

Ambition: Aligning with 1.5°C Global Warming Limit

The NZBA’s ambition is clear—support the transition to a net-zero economy by 2050, with interim targets that align with limiting global warming to 1.5°C above pre-industrial levels. This ambitious goal requires banks not only to minimize their carbon footprint but also actively finance the transition to a low-carbon economy.

Scope: Expansion to Include Capital Markets Activities

A pivotal update in Version 2 is the expanded scope of the guidelines to include banks’ capital market activities. This acknowledgment that capital markets play a crucial role in financing carbon-intensive industries underscores the need for banks to assess and manage the carbon impact of their underwriting, arranging, and advisory services.

Targets: Setting Interim and 2050 Targets

The guidelines mandate that banks set interim targets for 2030 and long-term targets for 2050. These targets must be science-based and align with pathways to limit global warming to 1.5°C. Interim targets are crucial for ensuring immediate action and enabling regular progress assessments toward the ultimate goal of net zero by 2050.

Reporting and Transparency Requirements

Transparency is at the heart of the NZBA guidelines. Banks are required to disclose their emissions and progress towards achieving their set targets annually. This level of transparency ensures accountability and enables stakeholders to monitor and evaluate the banks’ contributions to combatting climate change.

By adhering to these principles and targets, banks commit to a path of continuous improvement and adaptation in response to evolving climate science and economic realities. This commitment is not only about reducing emissions but also about fostering resilience and sustainability in the financial sector and the broader economy.

These guidelines represent a significant step forward in mobilizing the financial sector’s immense resources and influence towards achieving global climate goals. As financial institutions begin to implement these ambitious targets, the entire economy will be nudged towards a more sustainable trajectory, demonstrating the critical role of the banking sector in the global fight against climate change.

Implications for Banks

The NZBA Guidelines not only set a course for achieving net-zero emissions but also introduce a flexible yet accountable approach for banks through the “comply or explain” framework. This framework is pivotal, as it recognizes the diverse challenges and starting points of financial institutions worldwide while upholding the integrity and ambition of the NZBA’s objectives.

Understanding the “Comply or Explain” Framework

Flexibility: Banks are encouraged to meet the NZBA guidelines to the best of their ability, providing them with some flexibility in how they choose to implement the guidelines based on their unique circumstances, geographical locations, and operational capacities.

Accountability: When full compliance is not feasible, banks are required to provide a transparent explanation for their inability to meet specific guidelines. This requirement ensures that all member banks maintain a level of accountability to the alliance, their stakeholders, and the broader goal of climate action.

Operational Changes and Strategic Planning

Banks need to integrate climate considerations into their core business strategies, adjusting their operational practices, risk management frameworks, and client engagement processes. The “comply or explain” framework necessitates a deep dive into current practices, identifying areas for improvement and innovation.

Strategic planning must now encompass rigorous target setting, comprehensive emissions reporting, and regular reviews, all while preparing to explain any deviations from the set guidelines publicly.

Enhancing Transparency and Stakeholder Engagement

The framework boosts transparency in the banking sector’s efforts to combat climate change, encouraging banks to openly communicate their progress, challenges, and strategies for achieving their net-zero targets.

It fosters a closer engagement with stakeholders, including investors, clients, and regulatory bodies, providing them with clear insights into the bank’s commitment to sustainability and allowing for informed decision-making.

Comparative Analysis with Other Global Initiatives

The Net-Zero Banking Alliance (NZBA) is part of a growing global movement towards sustainability in the financial sector, complementing other initiatives aimed at integrating environmental, social, and governance (ESG) principles into financial decision-making.

While the NZBA focuses on aligning banks with net-zero emissions by 2050, it operates within a broader ecosystem of initiatives, each contributing unique perspectives and approaches to sustainable finance. A comparative analysis highlights how the NZBA aligns with, differs from, and complements these initiatives.

Task Force on Climate-related Financial Disclosures (TCFD)

Focus: The TCFD provides a framework for companies to disclose climate-related financial risks and opportunities.

Alignment: Both the NZBA and TCFD emphasize transparency and the need for financial institutions to assess and disclose climate-related risks. The NZBA’s reporting requirements are complementary, providing a more detailed pathway for banks specifically.

Difference: While the TCFD is broader in scope, applicable to all sectors, the NZBA provides banking-specific guidelines for achieving net-zero emissions.

Principles for Responsible Investment (PRI)

Focus: PRI encourages investors to use responsible investment practices that consider ESG factors to enhance returns and better manage risks.

Alignment: Both initiatives stress the importance of ESG considerations in financial activities. The NZBA targets the banking sector’s specific role in financing the transition to a low-carbon economy.

Difference: PRI is focused more broadly on investment practices across various asset classes, while the NZBA is specifically concerned with banking operations and their alignment with net-zero goals.

The Science Based Targets initiative (SBTi)

Focus: SBTi champions science-based target setting to reduce greenhouse gas emissions and drive corporate action on climate change across all sectors.

Alignment: The NZBA and SBTi both advocate for emissions reduction targets grounded in science to meet the goals of the Paris Agreement.

Difference: SBTi provides a cross-sector framework, whereas the NZBA offers guidance tailored to the banking industry, focusing on the sector’s unique challenges and opportunities in addressing climate change.

Conclusion

The Net-Zero Banking Alliance (NZBA) Version 2 Guidelines mark a pivotal moment for the banking industry’s role in climate action, setting a clear path towards net-zero emissions by 2050. By aligning with global initiatives like the TCFD, PRI, and SBTi, the NZBA underscores the financial sector’s critical contribution to sustainable development.

This collective effort highlights the power of financial institutions to influence a greener future, demonstrating that banking can be a significant force for positive environmental change. As we move forward, the commitment and actions of banks will be instrumental in driving the global transition to a sustainable and resilient economy.

Categories: Sustainability