For years financial institutions have been immersed in intense digital transformation processes with the aim of improving their value proposition, placing the client at the heart of business decisions and adapting to an ever-changing and extremely demanding environment. The pandemic has accelerated these processes and banks have focused on the need to enhance customer knowledge from a transversal viewpoint: what are their financial interests, what channels of interaction do they prefer, how and when do they want to be contacted, etc. This knowledge generates immediate positive effects on customer experience, and allows us to create solutions in line with new habits of consumers who demand increasingly agile and customisable services thanks to technology.

At Latinia, we have been designing real-time decision-making and communication software products for more than 20 years so that banks can offer a convenient, useful service based on filtering and analysing transactional events and customer intelligence data. Our Subscription Engine product allows you to accelerate the launch of notification processes from a fully customisable system, focused on driving customer insight by identifying which services have the highest penetration and activity.

Improved customer insight

“Analysing the degree and evolution of the adoption of notification services allows the bank to better understand its customers and their interests,” explains Juliana Ortiz, Latinia’s Customer Success Manager for Latin America. As a result of this analysis, “it is possible to adapt business strategies taking into account this data, focusing efforts on those services that enjoy greater acceptance and popularity”.

In addition, with the subscription module, bank customers can parameterise their own service through the bank’s digital channels and choose contact times, channels, etc. In short, as Juliana Ortiz points out, “it is the customers who personalise the service according to their preferences, bringing down to practically zero the margin of error that the bank assumes in the moment of providing a service that might be neither adequate nor well-valued”.

How is customer insight generated?

The platform that integrates the Latinia Subscription Engine offers analytical tools and very comprehensive graphs that make it possible to:

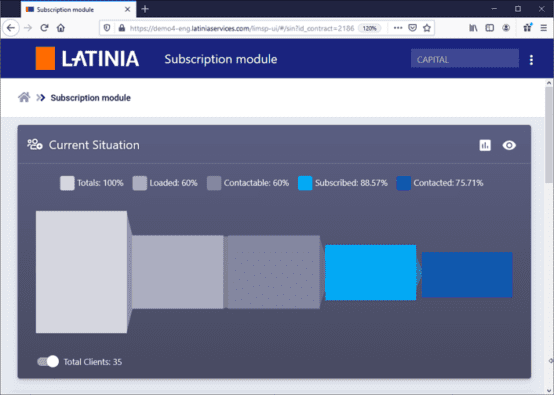

- Identify the level of contactability you have with your customers. Taking into account the bank’s customer base and how many of them are subscribed to the Engine, you can determine the number of subscribed customers, how many are contactable, how many are subscribed to notification services, and how many are contacted.

- Get to know customer interests. Usage statistics allow you to identify which services have the highest penetration in the customer base, as well as which services have the most notification activity.

- Gain understanding of the relationship being built through notification services. The tool shows in graphical format the daily and monthly progression of both subscription and contactability, of the customers of subscription services. This allows you to detect disinterest in the service, decrease or increase of alerts, etc.

Customer insight as a strategic decision-making tool

The metrics provided by the platform provide very valuable data for financial institutions as they allow conclusions to be drawn that could directly impact strategic business decisions. The periodicity recommended by Latinia to analyse data is monthly, although the platform provides this information as often as the bank wishes.

Business areas of the bank can interact with the platform directly as it has been designed to eliminate dependence on the bank’s IT and technological departments. The data is displayed in very detailed graphs, in a format that can be transferred to management reports to evaluate the success of services provided by the bank, as well as to take corrective action in the event of deviations from established targets.

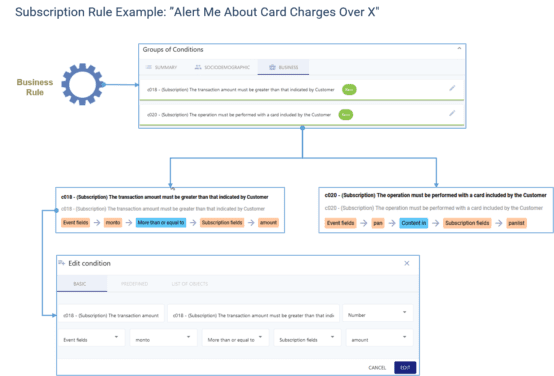

“Latinia’s Subscription Engine offers a user interface that simplifies and enhances the experience of employees in the bank’s business areas,” explains Juliana Ortiz. Thanks to this interface, “users can modify existing alerts, as well as create new ones without depending on the technology areas of the bank, making gains in agility and efficiency”, she concludes.