Introduction to Marketing Automation in Banking

What is Marketing Automation?

Marketing automation is a digital approach that employs software platforms and technologies specifically designed for marketing departments and organizations.

It streamlines, automates, and analyzes marketing tasks and workflows, such as email automation, social media posting, and website actions. This leads to increased efficiency and effectiveness of marketing campaigns and can significantly contribute to revenue growth.

Why Marketing Automation in Banking?

Marketing automation has emerged as an essential strategic tool in the banking sector. With it, banks can automate their customer communication processes, tailor personalized messages based on customer behavior and preferences, and streamline internal marketing workflows.

Marketing automation in the banking industry can help with tasks like lead generation, segmentation, customer lifecycle marketing, cross-selling and up-selling, customer retention, and measuring ROI.

Furthermore, it allows banks to track and analyze customer engagement and responses, enabling them to refine their strategies and enhance customer experiences.

Importance of Compliance and Data Security in Marketing Automation

Compliance in Banking

Banking operations are governed by a complex set of regulations to ensure financial stability, transparency, and consumer protection. Compliance ensures that banking operations, including marketing activities, adhere to these regulations, preventing reputational damage, legal sanctions, and significant financial penalties.

Data Security: An Essential Component in Banking

As banks handle sensitive customer data, data security becomes crucial. It is the practice of protecting digital data from unauthorized access, corruption, or theft throughout its lifecycle.

Protecting this data isn’t just a moral obligation; it’s also a legal requirement under regulations dictating the level of security that must be implemented to protect such data, like the EU’s General Data Protection Regulation (GDPR) and the US’s California Consumer Privacy Act (CCPA).

Integrating Compliance and Data Security in Marketing Automation

Regulatory Compliance in Marketing Automation: A Look at US and EU Regulations

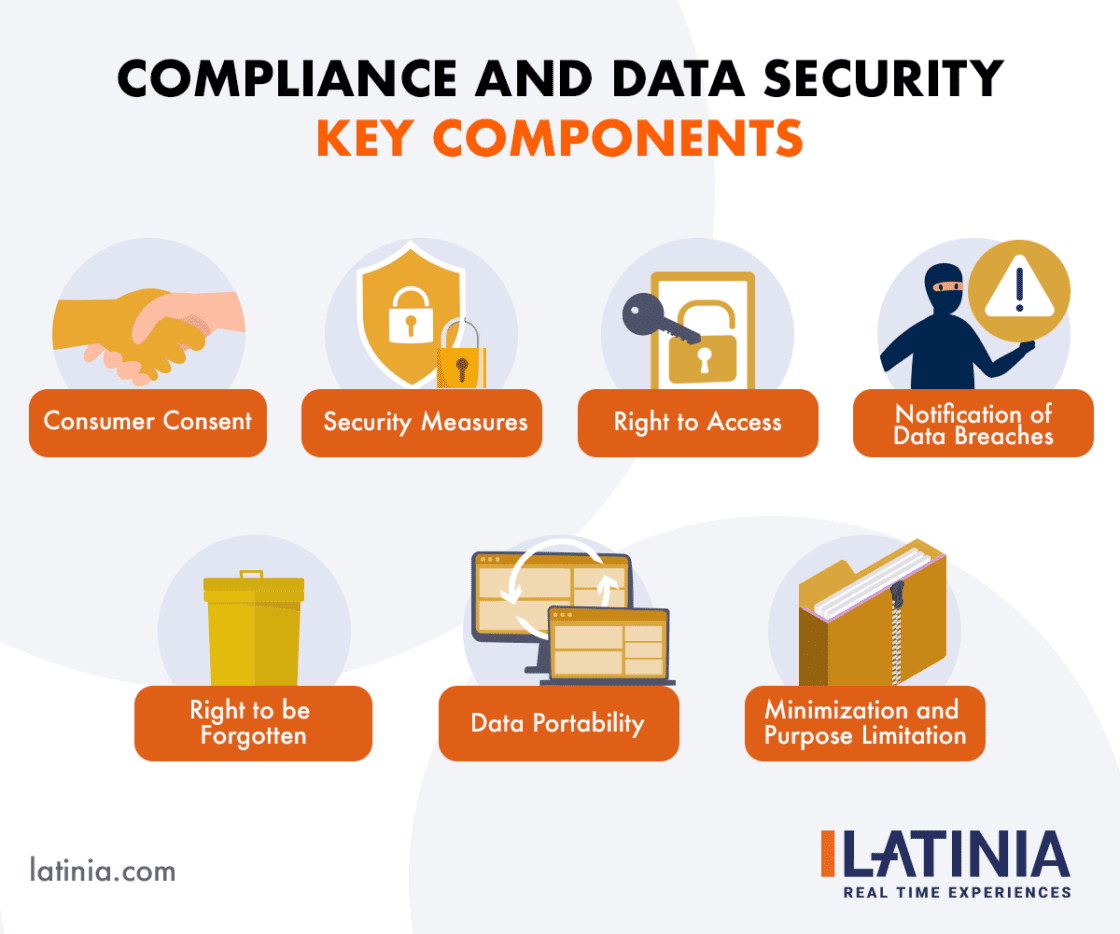

The CCPA (California Consumer Privacy Act) and GDPR (General Data Protection Regulation) are two significant data protection regulations that significantly affect marketing automation in banking. The key components of these regulations that are particularly relevant include:

1. Consumer Consent

Under both GDPR and CCPA, businesses are required to obtain explicit consent from consumers before collecting, processing, or storing their personal data. This consent must be freely given and based on a clear understanding of what data is being collected and how it will be used. For marketing automation in banking, this means that banks must ensure that they obtain valid consent before incorporating customer data into their marketing systems.

2. Right to Access

Both regulations give individuals the right to access their personal data. This means that banks must be able to provide customers with a copy of their personal data upon request. In the context of marketing automation, banks need to ensure that their systems are able to retrieve and provide this data in a clear and understandable format.

3. Right to Erasure (aka Right to be Forgotten)

Under the GDPR and CCPA, individuals have the right to request that their personal data be erased under certain circumstances, such as if the data is no longer necessary for the purpose it was collected or if the individual withdraws their consent. Banks, therefore, need to ensure that their marketing automation systems can quickly and completely erase personal data when requested by a customer.

4. Data Portability

The GDPR introduces the right to data portability, which allows individuals to obtain and reuse their personal data across different services. For banks, this means that their marketing automation systems must be able to provide personal data in a structured, commonly used, and machine-readable format when requested by the customer.

5. Security Measures

GDPR and CCPA require businesses to implement appropriate security measures to protect personal data. For banks, this could involve encrypting personal data, ensuring the secure transmission of data, and conducting regular security assessments and audits of their marketing automation systems.

6. Notification of Data Breaches

Under the GDPR, businesses are required to report certain types of data breaches to the relevant supervisory authority, and in some cases to the individuals affected, within 72 hours of becoming aware of the breach. The CCPA also mandates that consumers be notified of a data breach. This means that banks must have processes to quickly identify and report data breaches in their marketing automation systems.

7. Minimization and Purpose Limitation

The GDPR requires that personal data collected should be adequate, relevant, and limited to what is necessary in relation to the purposes for which they are processed (data minimization) and collected for specified, explicit and legitimate purposes and not further processed in a manner that is incompatible with those purposes (purpose limitation). This implies that every piece of customer data that banks collect in their marketing automation efforts should have a specific, lawful purpose, and unnecessary data collection should be avoided.

Ensuring Data Protection, Security, and Compliance in Marketing Automation Tools

Marketing automation tools can implement data protection, security, and compliance measures in various ways. Key functionalities to look out for include:

- Data Encryption: Data encryption is essential to secure sensitive customer data. To prevent data breaches, advanced encryption methods such as Transport Layer Security (TLS) and the Advanced Encryption Standard (AES) should be employed in marketing automation software.

- Access Controls: The software should have robust user access controls to ensure that only authorized personnel can access the system and the data within it. Role-based access control (RBAC) can provide an extra layer of security by limiting access based on user roles.

- Audit Logs: Audit logs record all the activities within the system, providing a detailed account of who did what and when. These logs are critical for detecting unauthorized access or changes and ensuring accountability.

- Compliance Management: The tool should support compliance with key regulations such as GDPR and CCPA. This can include features for obtaining and managing customer consent, providing data to customers upon request, erasing customer data when necessary, and more.

- Data Breach Notification: In the event of a data breach, it is crucial to promptly notify the relevant authorities and affected individuals. The marketing automation tool should have features that detect potential breaches and automate the notification process.

When evaluating a marketing automation tool, discussing these aspects with the vendor is crucial to ensure that their software is compliant. Here are some questions you can ask:

1. How does your software protect data? This can provide insights into the vendor’s data encryption methods and other security measures.

2. What access control methods are in place? This can help you understand how the system prevents unauthorized access.

3. How does your software support compliance with GDPR and CCPA? The answer will explain how the system manages customer consent, data access requests, data erasure requests, and more.

4. Does your software have audit log capabilities? Understanding how the system maintains audit logs can provide a sense of its transparency and accountability measures.

5. What processes are in place to identify and notify about data breaches? This can help you understand the system’s ability to respond promptly to data breaches.

In essence, ensuring that your marketing automation tool has strong data protection, security, and compliance measures in place is critical to safeguarding customer data and maintaining regulatory compliance. It requires careful consideration and a thorough understanding of the tool’s capabilities.

Leveraging Technology for Enhanced Security in Marketing Automation Tools

Several technological approaches can bolster the security of marketing automation tools and better ensure data protection and regulatory compliance:

1. Two-Factor Authentication (2FA): Two-Factor Authentication is a security process that requires users to provide two distinct forms of identification before accessing the system. This additional layer of security makes it more difficult for unauthorized users to gain access. Marketing automation software should ideally support 2FA, making it significantly harder for potential cybercriminals to compromise the system.

2. Encryption: As mentioned earlier, advanced encryption techniques such as Transport Layer Security (TLS) and Advanced Encryption Standard (AES) are instrumental in safeguarding sensitive customer data. These encryption techniques scramble the data to make it unreadable to anyone without the decryption key.

3. Intrusion Detection Systems (IDS): IDS are software applications that monitor network or system activities for malicious actions. They can detect potential breaches in real time and send alerts, helping to mitigate potential threats promptly.

4. Data Loss Prevention (DLP) Software: DLP software is designed to detect and prevent unauthorized outbound traffic of sensitive information. It can ensure that customer data is not misused or transferred without appropriate permissions.

5. Secure Sockets Layer (SSL) Certificates: SSL certificates provide a secure, encrypted connection between a server and a client—a website and a browser, for example. This certificate ensures that all data passed between the two remain private and integral.

When discussing with a vendor the features and capabilities of a marketing automation tool, ask what technologies are incorporated within the software to strengthen security, protect customer data, and maintain regulatory compliance.

Role of Latinia and Real-Time Analytics in Ensuring Compliance

While Latinia is not a marketing automation tool per se, it is a sophisticated real-time analysis and decision engine software.

Latinia’s specialty lies in analyzing both online and offline customer activities in real time. By capturing and interpreting data as it unfolds, Latinia gives companies the power to offer value, assistance, and relevant products or services precisely when their clients are most receptive. This ability to engage customers in the moment significantly enhances the customer experience and optimizes marketing effectiveness.

But Latinia’s strengths extend beyond real-time customer engagement. Its capabilities also play a crucial role in reinforcing compliance and security within banking operations. Latinia is equipped to navigate the complexity of changing regulations, helping banks prevent cyber threats and providing documented evidence of critical messages as required.

Furthermore, Latinia supports banks in combating identity theft, sending clients notifications for every login connection, keeping them informed and secure. Its fraud alert system leverages real-time data to identify suspicious activities or potential data breaches and alerts clients immediately, empowering them to act quickly.

Finally, Latinia affords full traceability control, giving banks access to all messages and customer data when required. This level of transparency is invaluable in resolving disputes and demonstrating compliance with regulatory requirements.

In essence, Latinia stands as a powerful tool in today’s digital banking landscape that complements marketing automation tools offering dynamic real-time customer engagement alongside robust compliance and security measures.

Challenges and Solutions in Ensuring Compliance and Data Security in Marketing Automation

Challenges in ensuring compliance and data security in marketing automation include managing consent across multiple channels, staying updated with changing regulations, and protecting against data breaches.

To overcome these challenges, banks must stay informed about changes in laws and regulations, ensure their marketing automation tools are compliant, implement robust security measures, and train their staff in compliance and data security.

Conclusion

Ensuring compliance and data security in marketing automation is crucial for banks. By integrating compliance and data security into their marketing automation strategies, banks can avoid legal pitfalls, protect their customers, and gain a competitive edge.

FAQs

1. What is marketing automation in banking?

Marketing automation in banking is the use of software to automate repetitive marketing tasks, such as lead generation and customer lifecycle marketing.

2. Why is compliance important in marketing automation for banking?

Compliance ensures that banks’ marketing activities adhere to relevant laws and regulations, helping avoid penalties and loss of customer trust.

3. What regulations do banks need to comply with in their marketing automation efforts?

Banks need to comply with regulations such as the GDPR in the EU and the CCPA in the US, which mandate personal data protection.

4. How can Latinia and real-time analytics help in ensuring compliance in marketing automation?

Latinia’s software can process real-time analytics and make real-time decisions, allowing banks to respond promptly to compliance issues.

5. What can banks do to ensure data security in marketing automation?

Banks can employ security technologies like encryption and two-factor authentication, ensure their marketing automation tools comply with data protection regulations, and train their staff in data security.

Categories: Security & Compliance